In Teva Pharmaceutical’s third quarter (Q3) 2023 report, the company reported a significant 7% increase in global revenues, bringing its Q3 sales to $3.9bn.

This surprising increase has been primarily driven by the robust performance of two of its key products: Austedo and Ajovy.

Austedo, a vesicular monoamine transporter type 2 inhibitor that was approved in the US in 2017, addresses tardive dyskinesia and chorea associated with Huntington’s disease.

Its mechanism of action involves the reversible depletion of monoamines, including dopamine, serotonin, norepinephrine, and histamine, from nerve terminals via its active metabolites, aligning with Teva’s commitment to developing innovative solutions.

The company had Q3 2023 sales of $339m, up 30.4% from Q3 2022, primarily due to the launch of its extended-release formulation, Austedo XR, which launched in mid-February 2023 in the US.

Along with Austedo’s sales growth, the demand for Ajovy is also growing, with sales reaching $114m in Q3 2023, an increase of 22.6% compared to Q3 2022.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFirst approved in 2018 for migraine prevention in the US, Ajovy is a monoclonal antibody targeting human calcitonin gene-related peptide.

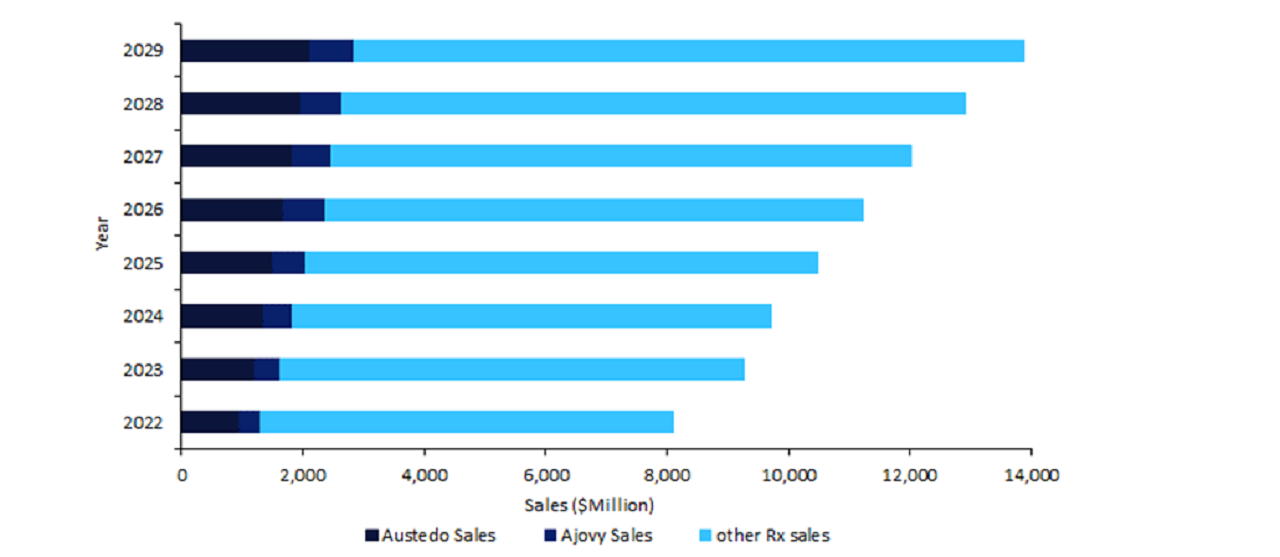

According to GlobalData’s Sales and Forecast tool, Austedo and Ajovy made up 60% of Teva’s sales in Q3 2023, and is forecast to account for 17% of the company’s total revenue in 2023.

GlobalData expects that demand for both Austedo and Ajovy will continue to grow substantially.

Austedo is forecast to achieve $2.1bn in sales in 2029, marking a substantial increase of approximately 119% from its 2022 sales of $963m.

This growth in demand can be attributed to an increase in the global ageing population and the increased use of antipsychotic medications, which often leads to patients developing tardive dyskinesia.

Meanwhile, Ajovy is on track to achieve sales of $719m in 2029. More gains are expected in Europe for Ajovy, where its sales revenue is projected to reach $243m in 2029 at a robust compound annual growth rate (CAGR) of 10.1%, compared to $392m in the US at a CAGR of 8.7%.

As Teva’s global sales are projected to reach $13.8bn in 2029, the combined forecast sales of Austedo and Ajovy at $2.842bn represent more than 20% of Teva’s total revenue for 2029.

The performance of Ajovy and Austedo will position them as key catalysts for a surge in Teva’s revenue in Q4 and beyond.

Austedo’s impressive growth trajectory in 2023 and Ajovy’s expanding market presence both bolster Teva’s current revenue and signal a resilient future revenue stream.

These two blockbusters stand as pivotal drivers of growth, ensuring Teva’s continued success in the pharmaceutical landscape.